Introduction to GLP-1 Agonists

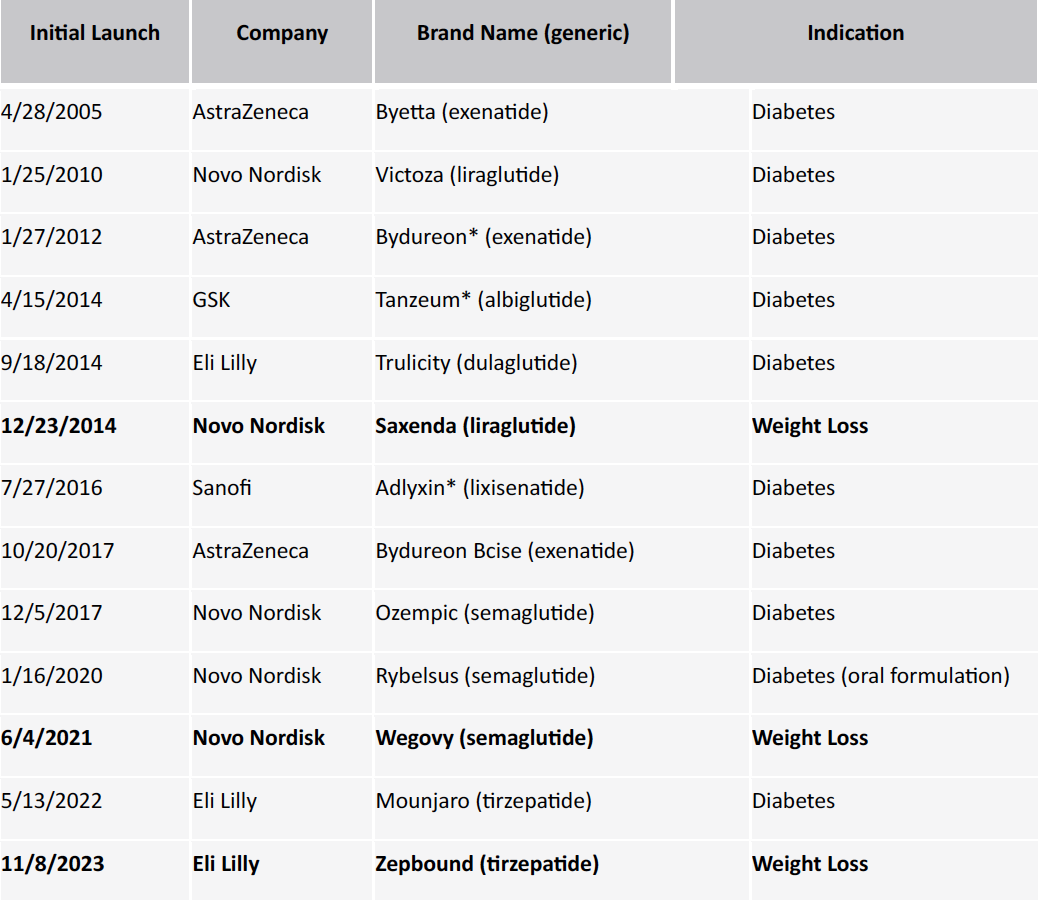

GLP-1 agonists have been pivotal in the pharmaceutical market for nearly two decades, beginning with the FDA approval of AstraZeneca’s Byetta in 2005. Since then, the landscape has seen numerous entries and exits, leaving Novo Nordisk and Eli Lilly as the primary players. These companies currently offer five GLP-1 drugs approved for type 2 diabetes, with four also approved for various cardiovascular conditions. The potential of GLP-1 agonists in weight loss has been a topic of ongoing discussion, but FDA approval for obesity has only been granted in the past decade.

Table 1. List of GLP-1 ini6al approvals since 2005

*products no longer on the market

Notable GLP-1 Agonists for Obesity

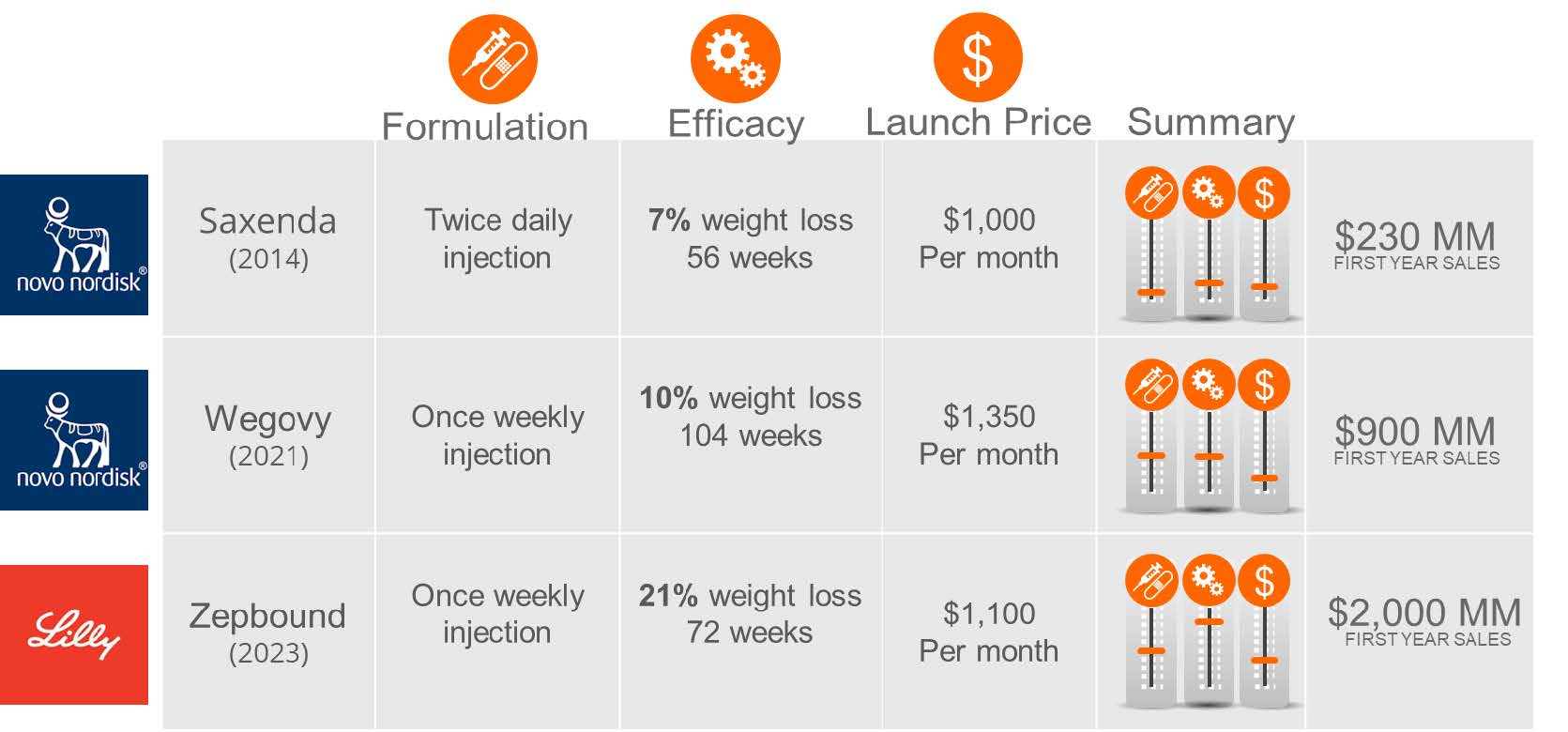

The first GLP-1 drug approved for obesity was Saxenda (liraglutide) from Novo Nordisk, a twice-daily injectable that demonstrated a 7% weight reduction over a year upon its approval. Saxenda’s approval set a precedent in efficacy and pricing, with a cost of over $1,000 per month. The market remained relatively static until 2021 when Novo Nordisk’s semaglutide (Ozempic for diabetes and Wegovy for obesity) was approved, showing nearly 10% weight loss over two years. Wegovy’s weekly injection and similar pricing to Saxenda led to an overwhelming market response, causing supply issues. In 2023, Eli Lilly entered the market with Zepbound (tirzepatide), boasting over 20% weight loss at 72 weeks and a slightly lower price.

Table 2. Summary table of the three obesity drugs with levers for ease of use, efficacy, and pricing.

Emerging Trends and Market Dynamics

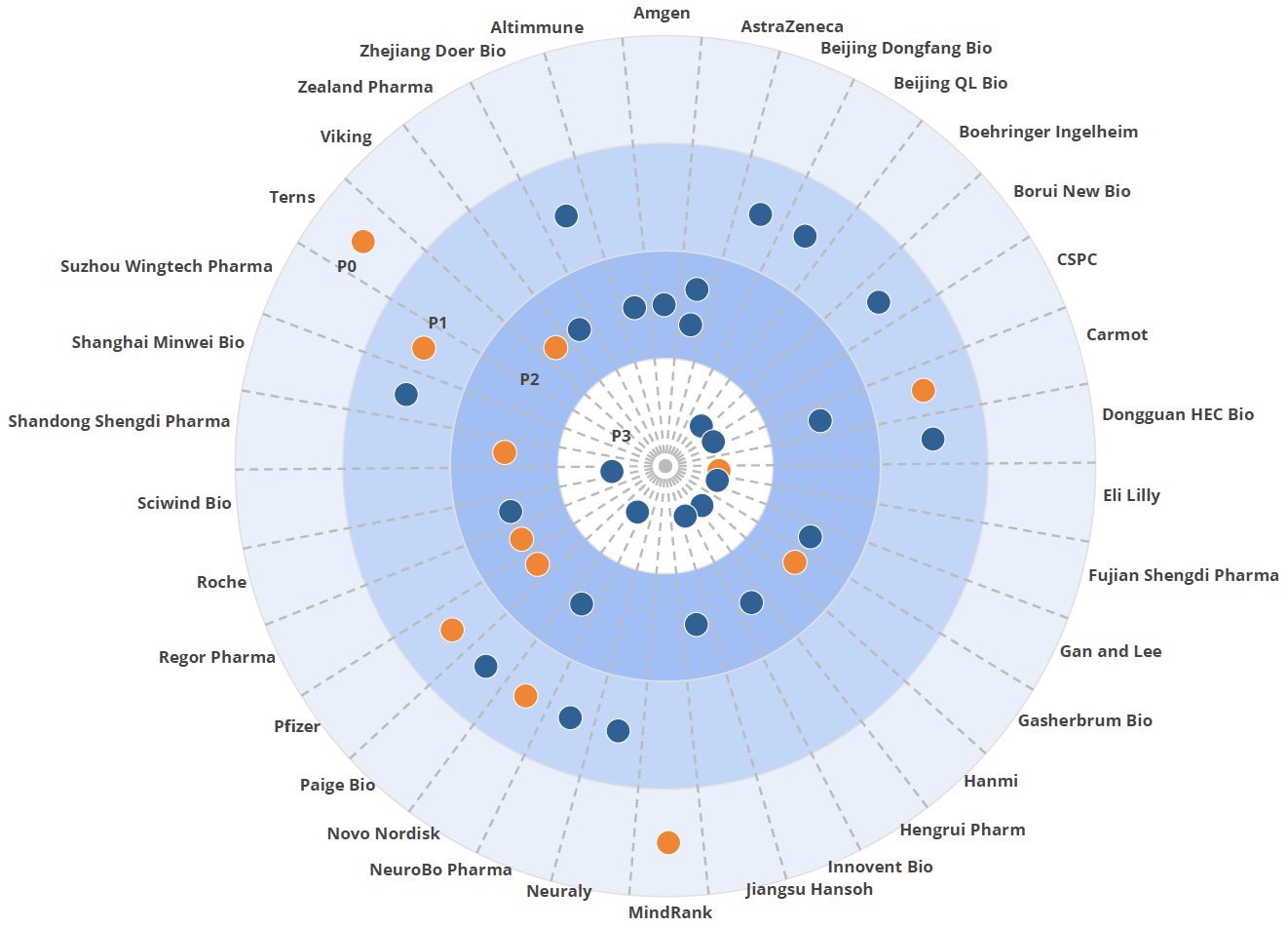

The GLP-1 market is poised for significant growth, with Novo Nordisk and Eli Lilly set to launch new injectables and oral formulations. Our review of the clinical trial pipeline reveals 39 new GLP-1 drugs in development from 34 companies, with only seven among the top 20 pharmaceutical companies. Many of these emerging players are based in China, indicating a potential shift in market dynamics unless major licensing or acquisition deals occur.

Figure 1. BEAM Bulls-eye chart highlighting the R&D landscape for GLP-1 drugs. The closer to the center a drug is, the closer to launch. Oral drugs are designated as orange dots, and blue designates the injectable treatments.

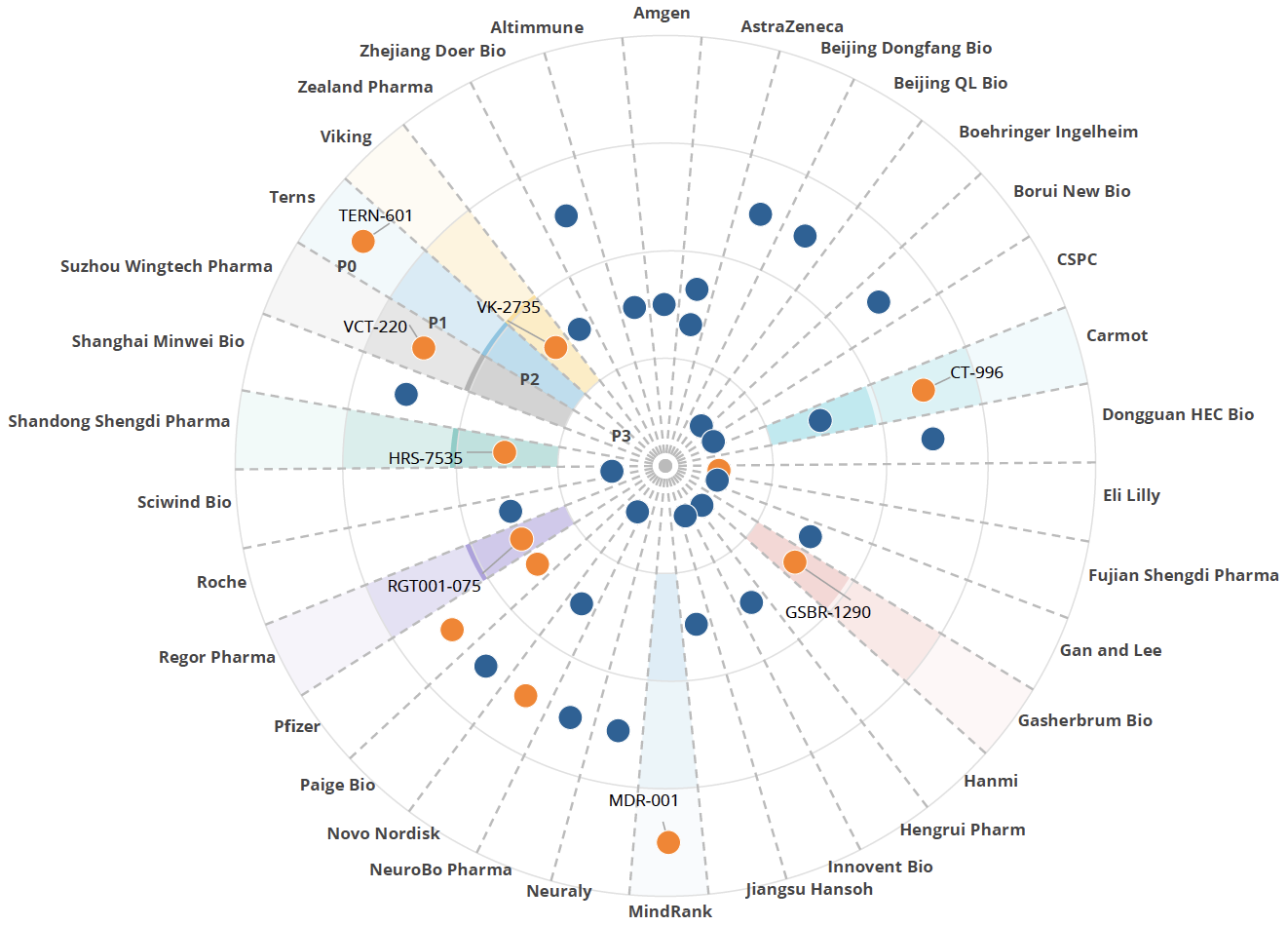

Figure 2. Highlighting the eight companies with potential to be acquired in the coming months.

Oral GLP-1 Formulations and Future Projections

Several companies are developing oral GLP-1 formulations, including Novo Nordisk, Pfizer, and smaller firms, positioning them as potential acquisition targets. We forecast one to two GLP-1 launches annually starting in 2026, with the first oral entrant expected by 2027. Injectable GLP-1 drugs will continue to be developed, with Novo Nordisk advancing multiple candidates. We anticipate around seven actual launches in the US by 2030 after risk-adjustment.

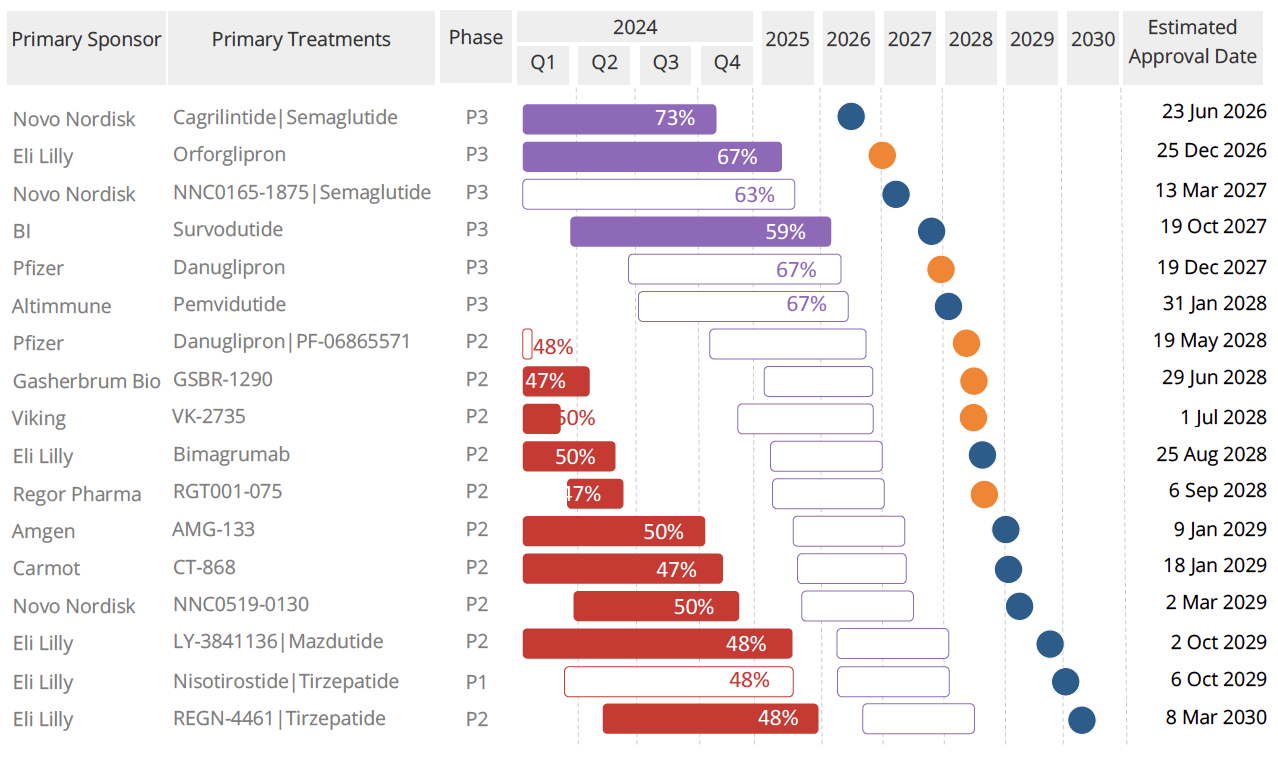

Figure 3. Clinical timing, risk, and approval estimates for upcoming GLP-1 U.S. launches. Oral drugs are designated as orange dots and blue designates the injectable treatments.

Catalyst Events and Market Watch

Significant upcoming catalyst events include the phase [name] readout of Eli Lilly’s glipron, which will indicate the efficacy of oral GLP-1s, followed by Pfizer’s glipron and other oral GLP-1s by 2028. An effective oral GLP-1 could challenge the current injectable market leaders and avoid supply chain issues. Additionally, companies are focusing on differentiating weight loss results in terms of muscle versus fat loss, with those showing minimal muscle loss likely to outperform.

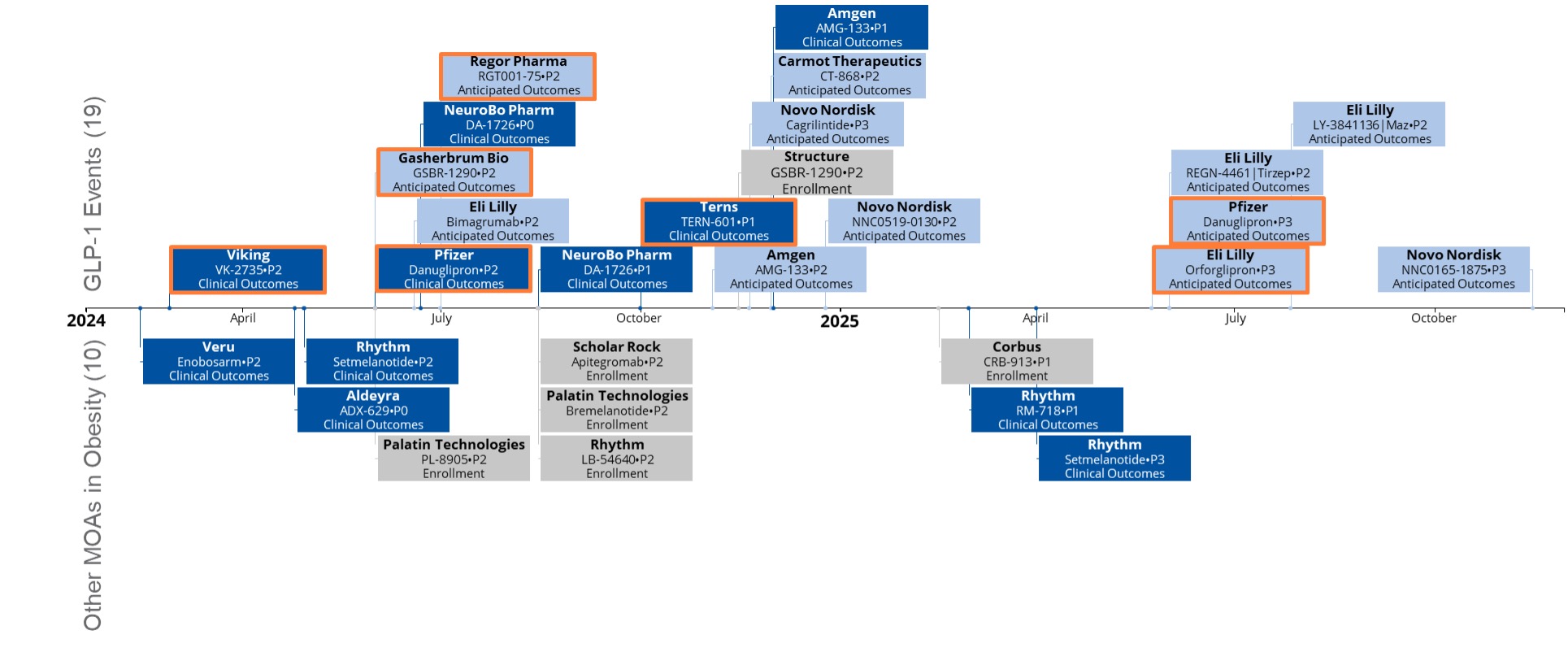

Figure 4. Upcoming catalyst events – the order and 6ming of expected GLP-1 and other clinical outcomes in weight loss/obesity to be announced.

Market Outlook and Strategic Insights

The obesity and weight loss treatment landscape will undergo substantial transformation in the coming years. Long-acting injectables may become initial treatments, followed by oral maintenance therapies. This shift could drive the obesity market to exceed $100 billion annually, reducing overall healthcare costs by addressing comorbidities associated with obesity. Despite limited big pharma involvement, venture funding is propelling new companies, potentially reshaping the industry landscape.

OZMOSI’s Data Intelligence Platforms: Driving Drug Development Strategies

OZMOSI leverages advanced data collection, refinement, and indexing techniques to support clinical and commercial strategy development. Our BEAM, PRYZM, and CTLYST platforms provide critical insights for identifying development programs, acquisition targets, and investment opportunities. Contact us to learn how OZMOSI’s data intelligence platform can enhance your team’s strategic initiatives.